Let me explain why buying stock with a note can be so amazing.

Imagine your employer offers you two alternatives: one million dollars worth of stock, or a stock option giving you the right to buy stock currently worth one million dollars. The stock option right lasts for ten years and if you choose to buy the stock you may do so at a cost equal to the stock’s value at the time of grant, i.e., one million dollars.

Easy choice you think. Take the stock award. In that case the stock is free, whereas in the second alternative you have to purchase the stock.

If taxes didn’t exist, it would be an easy choice. But let’s compare the tax results on receipt of the award. For this purpose, I am going to assume a flat 5% state tax rate and that the company is taxed as a corporation.[1]

- Accept the stock grant: pay $443,500 in tax today.[2]

- Accept the stock option grant: pay $0 today.

Suddenly the stock option is looking a lot more attractive, am I right?

But what happens on an exit? Let’s assume the stock is worth $3/share when the company is sold and that you still hold but have not yet purchased the stock underlying your stock option.

- Stock: You receive $3M which causes an additional $576,000 in tax.[3] Net after tax amount: $1,980,500 (i.e., $3M minus $443,500 minus $576,000).

- Unexercised stock option: You receives $2M in exchange for the cancellation of your stock option ($3M minus $1M exercise price) and owe $847,000 in tax[4]. Net after tax amount: $1,113,000.

Put simply, choosing to take the stock and pay the $443,500 in upfront tax would result in $800K more in your pocket at the end of the day on the above facts. But let’s face it, few of us have that kind of scratch laying around.

ENTER THE RISKY SILVER BULLET…

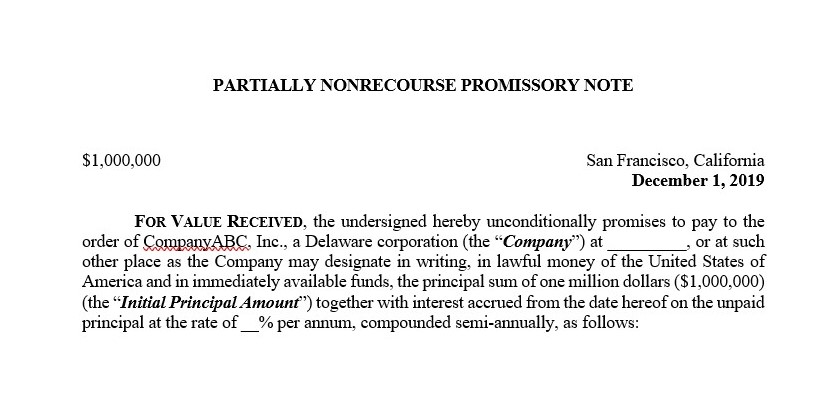

Buy the stock, using an IOU. “Dear Company, I promise I will pay you back $1M on the earlier of 9 years from now or a sale of the company.” The note needs to be at least 50% recourse, meaning that the stockholder will be personally liable for half of it.[5]

How much cash out of pocket does this require now? $0.

Ok, but what happens on an exit?

- Stock with promissory note: You receive $2M after repayment of the note and owe $576,000 in tax.[6] Net after tax amount: $1,424,000.

Not quite as good as the stock award alternative, but still $311,00 better than the stock option.

Before you get too excited…

Let me explain why buying stock with a note can be so risky.

What if instead of a high value exit event, the company stock drops to $0:

- Stock: The only way to recoup the $443,500 tax paid to the government is by using it to offset future capital gains, with $3,000 offsetting ordinary income per year.

- Unexercised stock option: Nothing happens. You paid nothing, you got nothing.

- Stock with promissory note: If the company forgives the note, you’ll owe $443,500 in tax on forgiveness of indebtedness income. If the company collects the $500K (remember the note is only 50% recourse), you’ll owe $500K plus $221,570 in tax on the portion not collected, or $721,570 total.

So, like the Tale of Two Cities, the promissory note alternative can be the best of times or the worst of times. If you’re super bullish on the company’s prospects and can accept the risk, ok. But if you wouldn’t walk down to your local bank and take a loan out to buy the company stock, then you probably shouldn’t buy it from the company using a promissory note either.

Mike Baker frequently advises with respect to stock purchased with a promissory note. He possesses a breadth and depth of experience in tax and employee benefits & compensation law that spans multiple decades. For additional information, please contact mike@mbakertaxlaw.com.

[1] Colorado would actually be 4.63%, Texas 0%, and California 9.3%+. If the company is taxed as a partnership, you should instead consider a profits interest.

[2] I am assuming the stock is vested or, if unvested, that a tax code Section 83(b) election is timely filed. This assumes a 37% federal rate, 1.45% Medicare, 0.9% additional Medicare, and 5% state tax. Withholding at the time of grant would likely use the 22% federal supplemental rate in large part, with the rest being owed by the taxpayer by April 15 of the following year (or earlier if she owes estimated tax).

[3] This assumes the capital gains rate of 20%, net investment income tax of 3.8%, and 5% state tax.

[4] This assumes a 37% federal rate, 1.45% Medicare, 0.9% additional Medicare, and 5% state tax.

[5] These notes do have an interest component, which I will ignore for simplicity for purposes of this article.

[6] This assumes the capital gains rate of 20%, net investment income tax of 3.8%, and 5% state tax.