by Mike Baker | Feb 9, 2026

Let’s say it’s February 2026 and you have some stock options you would like to grant members of your team. You’ve heard that you can rely on a tax code Section 409A valuation for up to 12 months. You received a valuation of $0.30 per share effective as of December...

by Mike Baker | Jan 28, 2026

Myth: You must grant stock options with a fair market value exercise price. Truth: A nonstatutory stock option can be granted with a discount exercise price if: The stock option is fixed-exercise; or The stock option meets the independent contractor exception. Most...

by Mike Baker | Jan 23, 2026

Occasionally a company calls me and asks me about granting a stock award to a service provider in a foreign country. That can be done, though it often involves drafting an international form of stock award agreement, sometimes involves adopting a sub-plan to be...

by Mike Baker | Jan 20, 2026

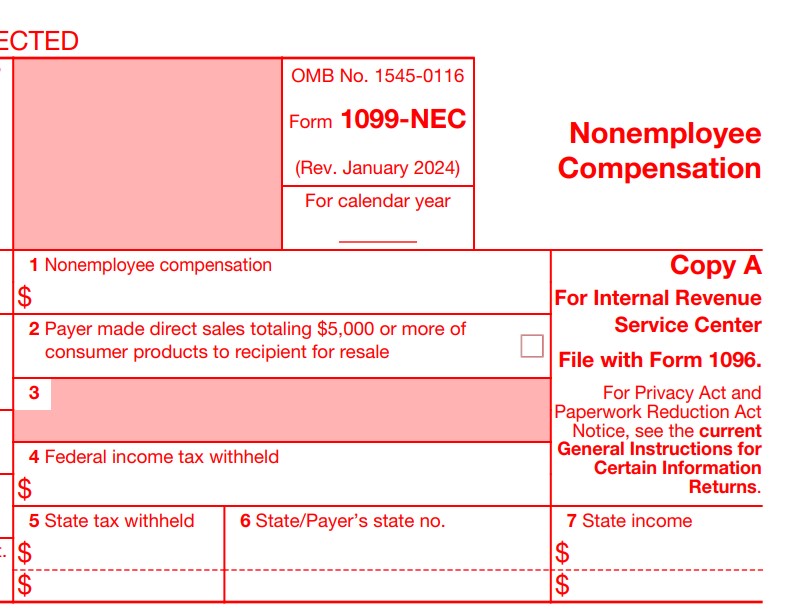

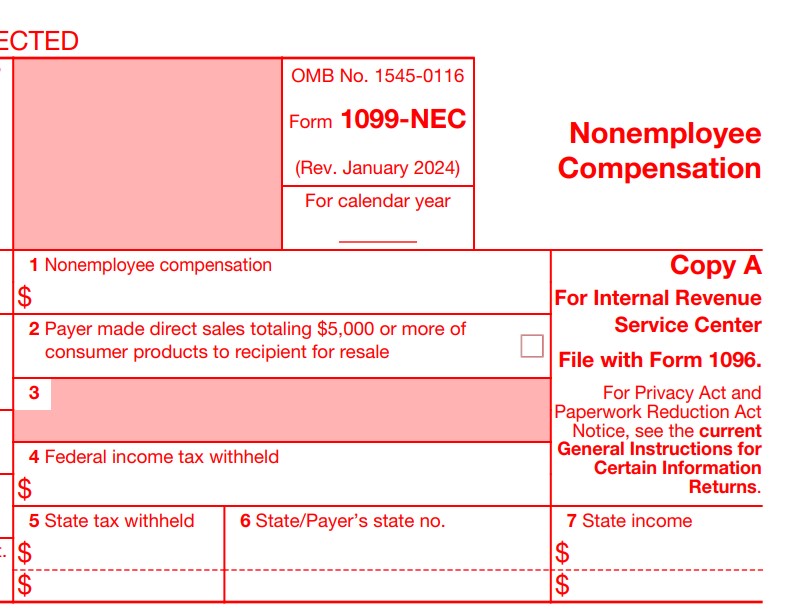

It’s 1099 season. For those of you who paid a law firm for legal services this year, here are three tips: 1. Payment for legal services goes in box 1 of Form 1099-NEC. Do not use Form 1099-MISC. Form 1099-MISC box 10 “Gross proceeds paid to any...

by Mike Baker | Jan 18, 2026

Updated. Originally posted September 14, 2019. Once there was a beautiful tech incubator named Y Combinator. In a dream one night she saw herself curing every start-up’s funding woes with a magical new creature called a SAFE. When she woke up, she got to work creating...