Baker Tax Blog

Stale 409A Valuation

Let’s say it’s February 2026 and you have some stock options you would like to grant members of your team. You’ve heard that you can rely on a tax code Section 409A valuation for up to 12 months. You received a valuation of $0.30 per share effective as of December...

Discount Stock Options

Myth: You must grant stock options with a fair market value exercise price. Truth: A nonstatutory stock option can be granted with a discount exercise price if: The stock option is fixed-exercise; or The stock option meets the independent contractor exception. Most...

Section 83(b) Elections and Non-US Persons

Occasionally a company calls me and asks me about granting a stock award to a service provider in a foreign country. That can be done, though it often involves drafting an international form of stock award agreement, sometimes involves adopting a sub-plan to be...

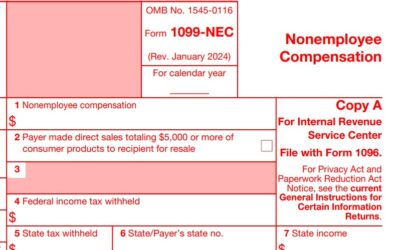

Form 1099-NEC and Legal Services

It's 1099 season. For those of you who paid a law firm for legal services this year, here are three tips: 1. Payment for legal services goes in box 1 of Form 1099-NEC. Do not use Form 1099-MISC. Form 1099-MISC box 10 "Gross proceeds paid to any attorney" is for when...

SAFEs in LLCs

Updated. Originally posted September 14, 2019. Once there was a beautiful tech incubator named Y Combinator. In a dream one night she saw herself curing every start-up’s funding woes with a magical new creature called a SAFE. When she woke up, she got to work creating...

Fixing a Missed 83(b) Election

“You filed your Section 83(b) election, right?” Silence. “Right?” I gave a presentation years ago on how to fix a missed tax code Section 83(b) election. My phone started ringing the moment I returned to my office. Turns out, these get missed. Apparently, founders...

Transferring a Stock Option

I occasionally get asked whether it is possible to transfer a stock option. Listed below are relevant considerations. Does the plan allow for it? Carefully read the stock option plan and agreement to see if there are any restrictions on option transfer. There...

Year-End Tax Moves

You’ve got about three weeks left in 2025, which means there’s still time for some last-minute, tax planning. Here are ten ideas to consider before December 31: 1. Accelerate deductible business payments (cash-basis taxpayers)If you own or operate a cash-basis...

Secondary Purchase plus Exchange

Updated. Originally posted November 3, 2022. Over the past six years, a particular method for providing founder liquidity has gained significant popularity: an investor purchases common stock from founders during a preferred financing at the preferred price. The...

What’s Lurking in Your Cap Table?

What’s Lurking in Your Cap Table? A clean capitalization table (or “cap table”) isn’t just good housekeeping—it’s a critical part of maintaining your company’s legal and tax health. Yet many founders discover, often too late, that their cap table hides costly issues...

2026 Tax Rates

The tax rates and deduction amounts for the 2026 calendar year are listed below. Federal ordinary income tax rates Single taxpayers If taxable income is between: The tax is: $0 – 12,400 10% of taxable income 12,400 – 50,400...

Lisa Okragly – MBA, CPA, and Tax Attorney

My journey to becoming a tax attorney at Baker Tax Law has been shaped by a lifelong interest in both law and business—and by the satisfaction I find in solving complex problems through careful analysis and clear communication. I began my career in business and...