by Mike Baker | Mar 23, 2024

How do you pay zero federal tax on up to $10,000,000? Invest in a qualified small business. General speaking, a qualified small business is: A domestic C corporation; Which, at all times up to the time immediately following the issuance of your stock, had less than...

by Mike Baker | Mar 6, 2024

Let’s say it’s March 2024 and you have some stock options you would like to grant members of your team. You’ve heard that you can rely on a tax code Section 409A valuation for up to 12 months. You received a valuation of $0.30 per share effective as of December 31,...

by Chase Manderino | Feb 1, 2024

Updated August 20, 2024 Certain recent changes to tax code Section 174 may negatively affect companies that have research and development (R&D) expenses. Here’s the basic problem: If in 2023 you spent $1M to make $1.2M then you have $200K of profit. If we lived...

by Mike Baker | Jan 12, 2024

Let’s say you have some intellectual property (IP) that you’d like to give to a corporation in exchange for shares of its common stock. The IP and stock are both worth $10,000 and you have tax basis in the IP of $800. Normally such an exchange would...

by Mike Baker | Jan 10, 2024

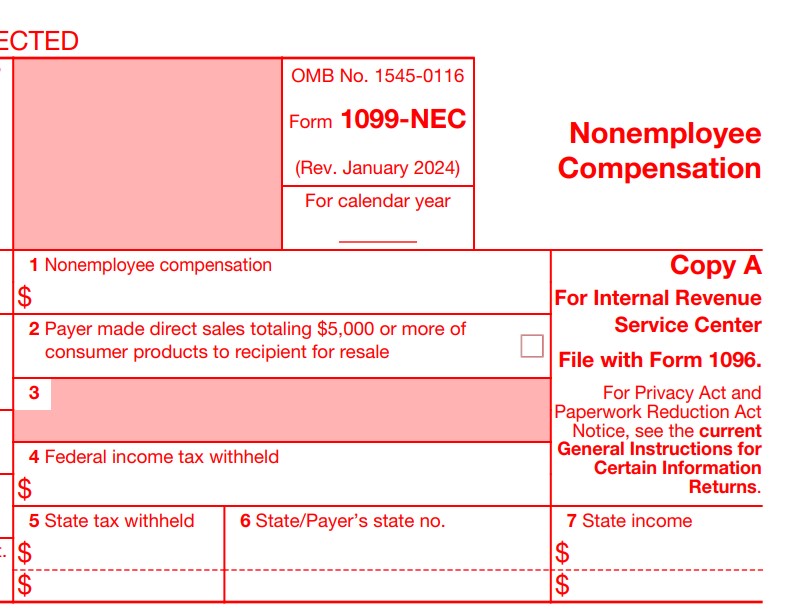

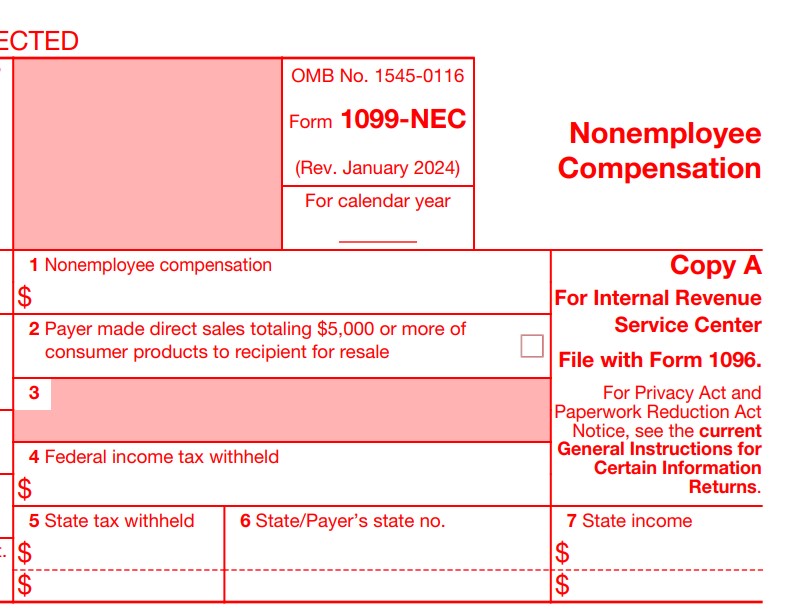

It’s 1099 season. For those of you who paid a law firm for legal services this year, here are three tips: 1. Payment for legal services goes in box 1 of Form 1099-NEC. Do not use Form 1099-MISC. Form 1099-MISC box 10 “Gross proceeds paid to any...

by Mike Baker | Dec 26, 2023

Let’s say you’re the majority shareholder of ABC, Inc., a C corporation, which just sold substantially all of its assets in a taxable asset sale. The deal consideration consists of three parts (i) $30M to be paid at closing, (ii) $3M which is being held...