Baker Tax Law

We support executives and emerging companies

Need a corporate attorney? We partner with corporate law firms

Practice Areas

Tax Law

We provide tax advice and planning for companies and individuals on a wide range of federal tax issues

Employee Benefits & Compensation

We help companies to structure benefit programs and to comply with the laws governing compensation

Employment

We help executives negotiate their employment, equity compensation, and separation packages

Recent Posts

Stock Option Extensions

You have an employee who is leaving. She tells you she doesn’t have the cash to exercise her Company stock option in the first three months post-termination and she realizes if she doesn’t the option will expire. She pleads with you to do something and you are willing...

Partners at Kirkland & Ellis use this one trick…

You can tell the difference between equity and non-equity partners at Kirkland & Ellis by looking to see if they have “P.C.” after their name. It’s true. See here for an example of an equity partner and here for an example of a non-equity partner. Still skeptical?...

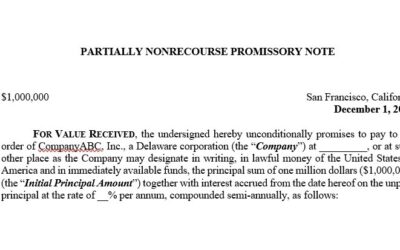

The Risky Silver Bullet: Purchasing Stock with a Promissory Note

Let me explain why buying stock with a note can be so amazing. Imagine your employer offers you two alternatives: one million dollars worth of stock, or a stock option giving you the right to buy stock currently worth one million dollars. The stock option right lasts...