Baker Tax Law

We support executives and emerging companies

Need a corporate attorney? We partner with corporate law firms

Practice Areas

Tax Law

We provide tax advice and planning for companies and individuals on a wide range of federal tax issues

Employee Benefits & Compensation

We help companies to structure benefit programs and to comply with the laws governing compensation

Employment

We help executives negotiate their employment, equity compensation, and separation packages

Recent Posts

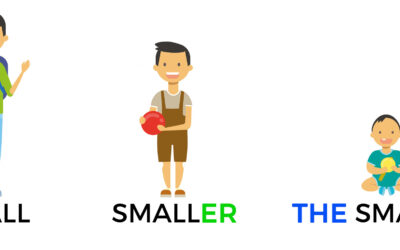

Just How Small Can a Partner Interest Be

Venture capital and private equity fund sponsors frequently ask “how much money do I actually have to contribute to a partnership as the general partner (or “GP”)?” Unfortunately, the answer is that old tax lawyer chestnut: “It’s not entirely clear, and largely...

Disproportionate Allocation of Deal Proceeds

Pretend you have a preferred equity investment in a company, entitling you to a 2x return before common holders participate in deal or liquidation proceeds. A buyout term sheet arrives, and while the valuation would only get you a 1.8x return, that’s more than enough,...

QSBS – Limits on Types of Assets Held

How do you pay zero federal tax on up to $10,000,000? Invest in a qualified small business. General speaking, a qualified small business is: A domestic C corporation; Which, at all times up to the time immediately following the issuance of your stock, had less than...