Baker Tax Law

We support executives and emerging companies

Need a corporate attorney? We partner with corporate law firms

Practice Areas

Tax Law

We provide tax advice and planning for companies and individuals on a wide range of federal tax issues

Employee Benefits & Compensation

We help companies to structure benefit programs and to comply with the laws governing compensation

Employment

We help executives negotiate their employment, equity compensation, and separation packages

Recent Posts

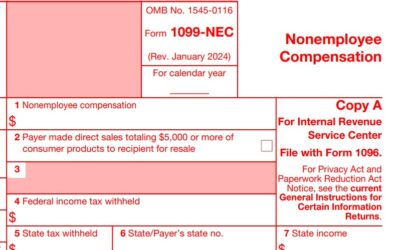

Form 1099-NEC and Legal Services

It's 1099 season. For those of you who paid a law firm for legal services this year, here are three tips: 1. Payment for legal services goes in box 1 of Form 1099-NEC. Do not use Form 1099-MISC. Form 1099-MISC box 10 "Gross proceeds paid to any attorney" is for when...

Liquidating after an Asset Sale

Let's say you're the majority shareholder of ABC, Inc., a C corporation, which just sold substantially all of its assets in a taxable asset sale. The deal consideration consists of three parts (i) $30M to be paid at closing, (ii) $3M which is being held back in an...

SAFEs in LLCs

Updated. Originally posted September 14, 2019. Once there was a beautiful tech incubator named Y Combinator. In a dream one night she saw herself curing every start-up’s funding woes with a magical new creature called a SAFE. When she woke up, she got to work creating...